How to add and update the occupancy taxes and guest fees collected from guests for stays at your property

Taxes are a reality for business owners, and short-term rental businesses are no exception. There are lots of nuances that you should research and understand when it comes to taxes for your rental bookings -- you don't want to have an unpleasant surprise at tax time and discover you've been undercollecting throughout the year.

Required taxes applied to short-term rental vary from location to location, and can include:

- State sales tax

- Local sales tax

- Lodging tax

- Occupancy tax

- Resort tax

- Hospitality tax

Note that these taxes are not the same as any property taxes you may owe -- this is only referring to the occupancy/booking/sales taxes that you are obligated to collect from guests for stays at your short-term rental.

You should look up your local and state short-term rental, resort, and hospitality tax responsibility on websites like Avalara or your state’s Department of Revenue. Many states, cities, and towns also have their own sales tax calculator where you can look up how much you need to collect.

You can also ask a local tax attorney or certified public accountant (CPA) for guidance on short-term rental taxes in your property's jurisdiction. A local or or regional short-term rental advocacy group is another great resource for learning about tax collection requirements in your area.

How do I set up my property's tax rate on Futurestay?

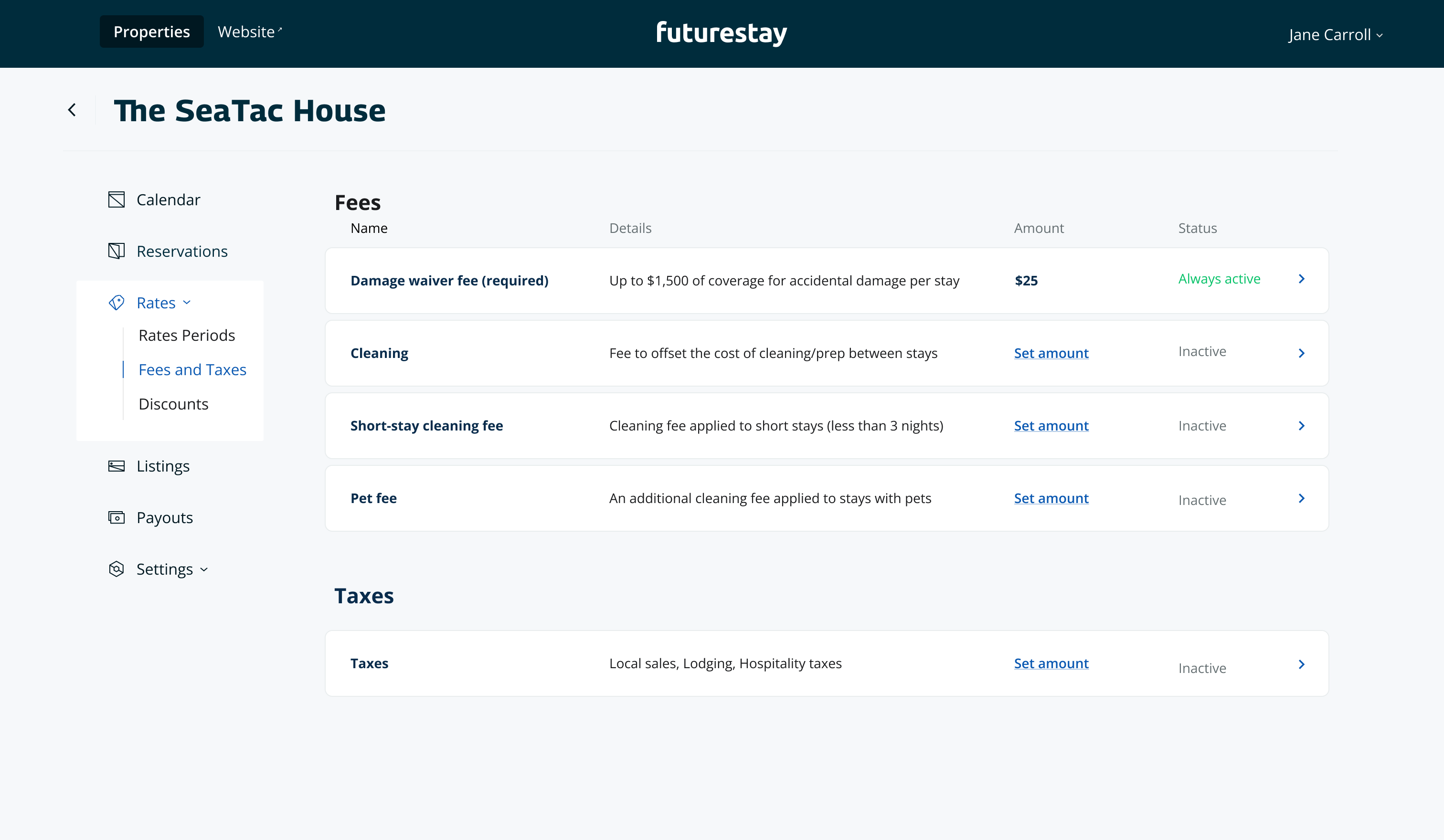

In your Futurestay dashboard, you can indicate the taxes to be collected from guests when they book your property.

You'll need to update the tax rate information for each property:

- Navigate to the property's settings in your Futurestay dashboard, then to Rates > Fees and Taxes.

- Enter the total tax rate to be collected from guests at the time of booking

- For example, if you are required to collect a local lodging tax of 3.25%, plus sales tax of 4.5%, your total to collect is 7.75%

How do I pay out the collected taxes?

Futurestay collects taxes from bookings where Futurestay acts as the payment processor, passing the collected tax amount on to you in your payout for each reservation. You are responsible for then remitting the taxes due to the applicable tax departments for your property's jurisdiction.

For bookings where Futurestay is not the payment processor, you should consult if the payment processor collects and remits taxes on your behalf or if you are responsible for remitting taxes.

Booking fees

Per-stay guest fees can help cover the cost of operating your short-term rental business. Some guest-facing fees, like cleaning fees, are optional, while others are required, like the damage waiver that Futurestay automatically applies when a guest books your property.

You don't have collect a cleaning fee, but if you add one, it will be required when guests book your property.

Setting up your taxes and fees on Futurestay

Manage your property's fees and taxes in the Futurestay by navigating to the property, then to the Rates menu, and selecting "Fees and Taxes":

Have questions?

Email us at service@futurestay.com or chat with a member of our team by clicking on the chat icon in the lower left hand corner of your screen.